Do you feel like your property taxes are too high?

Is the assessed value of your home higher than what online estimators say it’s worth?

If so, you might have a case for lowering your property taxes. In that case, you will want a property tax appeal appraisal.

An appraisal is a necessary tool to have when applying for lower property taxes. You can submit the paperwork with similar sales that you think would show a lower value, but this doesn’t always work.

When you get a property tax appeal appraisal, you have a signed document by a licensed appraiser that will help prove your case. Appraisers know your market and can get you the most accurate estimate of value. This way, you will have the best evidence of an overassessment.

What is a property tax appeal appraisal?

A property tax appeal appraisal is a real estate appraisal you can use to help appeal your property taxes.

If you own a house, you will pay property taxes every year. The tax assessor assesses your house when you buy it, and this assessment increases by a percentage every year, even if the market is going down. This can be a problem for you, especially if the market decreases significantly.

If you think the assessed value of your property is higher than it is worth, you can apply to appeal the taxes each year. You can submit your comparables to help show the decrease in value, but with a legitimate appraisal, your case is much more solid.

Why do I need a property tax appeal appraisal?

The most common scenario you might find yourself in is as follows:

- You buy a property at the top of the market

- The property is reassessed at that value.

- Now, you are paying property taxes on that value.

- The market declines, and your property is worth 75% of what you paid for it.

- Now, you are overpaying for property taxes, which will continue to increase yearly.

Does this sound familiar to you?

Let’s see an example.

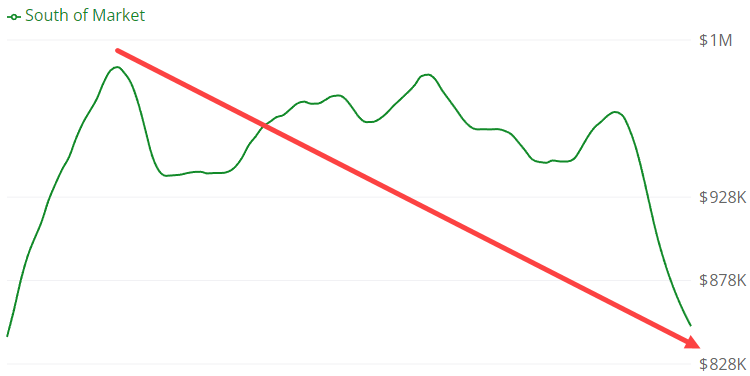

You bought a condo in SoMa in early 2016 for $1,000,000 (Height of the market), which was assessed for the same value.

The property is now worth $850,000 a few years later, but the assessed value has increased to $1,100,000.

You should be paying $10,030 per year in property taxes, but instead, you are paying $12,980. That is an overpayment of almost $3,000 per year.

Now is the time to get a property tax appeal appraisal to help appeal your property taxes.

How can a property tax appeal appraisal help me win my case?

It is important to have a property tax appeal appraisal if you want the tax assessor to take you seriously.

Real estate appraisers value property for a living. They know the markets and how to determine the value of real estate. They will produce a professional, unbiased appraisal that will give you more credibility.

You can submit your own comparables in the application, but do you know which to choose and which to avoid?

You may go through the whole process only to find out that the comparables you chose don’t show a lower value, or worse, a higher value.

A property tax appeal appraisal will help to squash all doubts in your and the tax assessor’s mind.

Can I appeal my property tax assessment without an appraisal?

An appraisal is not required to appeal your property taxes.

You are free to submit comparable properties and hope for the best. But choosing comparables is not as simple as pulling up Zillow and picking.

Detailed analysis goes into the appraisal process; choosing comparables is the most important part.

I have talked to homeowners that were unsuccessful in the past and have now come to me to help them with a legitimate appraisal for their subsequent appeal.

With a signed appraisal by a California state-certified appraiser, your chances of success are much higher.

How do I request a property tax appeal appraisal?

To request a property tax appeal appraisal, fill out this form (link) and check the box that says “Property Tax Appeal”.

Once we receive your submission, we will get back to you with an appraisal fee quote and turnaround time.

If you wish to continue with the process after that, we will schedule a time for the inspection. The inspection should take roughly 30 minutes. It may be more or less, depending on the size of the property.

After the inspection, we will write the report up at our office and email you a PDF copy once complete. The entire process should take around one week or two weeks at the most.

How much does a property tax appeal appraisal cost?

The cost for a property tax appeal appraisal can range depending on the size of the property, complexity, location, and appraisal type.

The baseline fee is around $350 for an exterior-only inspection, but the fee can go beyond $1,000 or more for a large complex property.

Why choose Realvals for your property tax appeal appraisal?

If you want a real chance at appealing your property taxes, it is essential to hire a professional appraiser.

Here at Realvals, we are no strangers to property tax appeal appraisals. We have helped many homeowners with the appraisals they needed to appeal their property taxes successfully, and we want to help you too.

You could be potentially overpaying by thousands each year on your property taxes. We can help you get what you need to overcome this burden.

If you live in the San Francisco Bay Area and think you are overpaying on property taxes, let us help you. We can provide a signed appraisal report by a California state-certified appraiser. The report will be thorough, reliable, and non-biased. It will help your case against the tax assessor if the value is lower than the current assessment.

Get Your Free Appraisal Fee Quote

If you need a property tax appeal appraisal, click the button below to get started today.

For more information on Marin County property tax appeals, click here

For more information on San Francisco County property tax appeals, click here

For more information on Sonoma County property tax appeals, click here