Reading an appraisal report for the first time can be quite daunting.

Whether you are a first-time homeowner or it’s your first time reading an appraisal for any reason, it’s quite a lot of information to take in at once.

Most appraisals are 20+ pages long, filled with boilerplate text and information that is not necessarily relevant to you as the reader.

This post will guide you through the appraisal report section by section in hopes that you can understand every aspect from start to finish.

I will use this uniform residential appraisal report sample for this article. This is the form most commonly used for conventional loans on purchases or refinances.

Home Appraisal Report Sections

The central part of the home appraisal report is broken down into several sections over multiple pages. For a 1004 appraisal report, it is six pages.

Page one contains the subject, contract, neighborhood, site, and improvement sections.

Page two contains the sales comparables, with the reconciliation at the bottom. The following page may include additional comparables (Which are not counted in the page count).

Page three contains additional comments, additional approaches to value, and a section for planned unit development properties.

Pages four through six are all boilerplate text required in every 1004 single-family residential appraisal.

In addition to these six pages, there will usually be some kind of cover page or letter, photos, maps, charts, and other supporting documents.

Cover Page/ Appraiser Cover Letter

The cover page is usually the first page of the appraisal.

It usually has the home address, photo, and client information. Sometimes, it might have the appraised value and a table of contents.

Sometimes, the cover page might be in the form of a cover letter from the appraiser explaining the assignment, subject property, and client information.

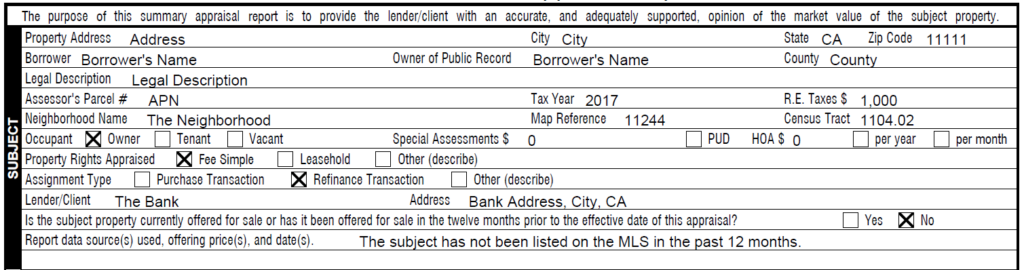

Page One – Subject

The subject section contains all the relevant information about the property’s location, assignment type, client information, and past listings.

It starts with the address across the top. Then, the borrower’s name and owner are mentioned on public records.

The legal description, parcel number, tax year, and annual taxes are next.

This is followed by neighborhood name, occupant type, PUD/HOA info, property rights appraised, and assignment type.

Then, it goes into the client to determine whether the house has been listed in the last 12 months.

All of this is pretty straightforward, but if you have any questions, feel free to ask in the comments at the end of the article.

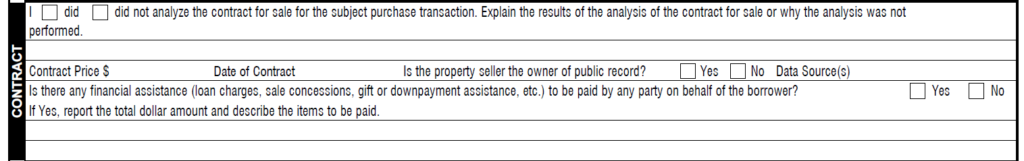

Page One – Contract

The contract section is only used when the purpose of the appraisal is for a purchase.

This is a short section where the relevant sale information is located.

It contains the purchase price, date, concessions, etc.

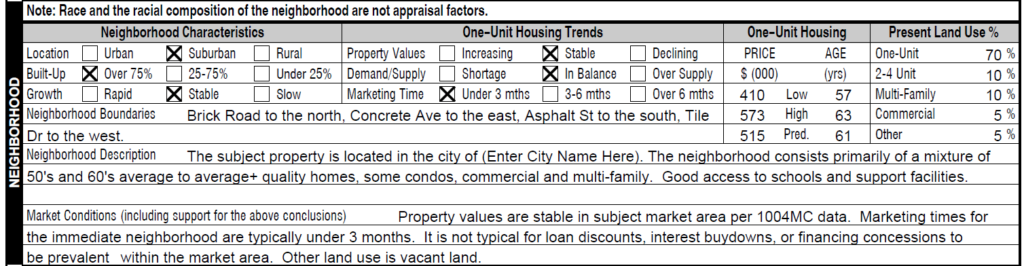

Page One – Neighborhood

The neighborhood section talks about the neighborhood.

It starts with the neighborhood characteristics, like location (Urban, suburban, rural), how built-up the neighborhood is, and the growth rate.

The “One-Unit Housing Trends” section is based on comparable properties instead of the overall neighborhood.

The “One-Unit Housing” section applies to the overall neighborhood. It shows the low, high, and predominant prices and ages.

The present land use section is usually estimated and is split into one-unit, 2-4 unit, multi-family, commercial, and other.

The neighborhood boundaries and description sections should describe the neighborhood and its north, west, south, and east boundaries.

The market conditions section is based on the market conditions of comparable properties.

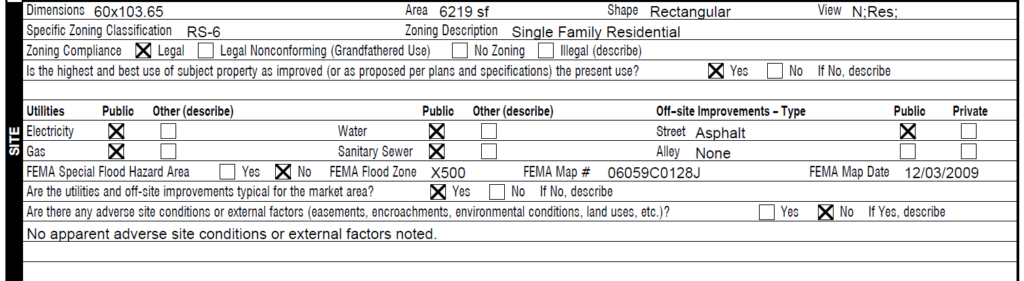

Page One – Site

The site section has information specific to the subject’s site.

It starts with the lot dimensions, size, shape, and view. If it is an irregular-shaped lot, the dimensions section will often say something like “Refer to Plat Map.”

The next sections are for the current zoning and if the property complies with the current zoning. The appraiser should describe the zoning in detail.

The highest and best use section is probably not important to you, the homeowner, but is very important in the evaluation process. It basically explains whether or not the property’s current use is the best use.

Next are the utilities and off-site improvements, followed by the flood zone and flood map information.

The final checkboxes are related to utilities and whether or not there are adverse site conditions or external factors. A busy road location or adjacent commercial property is an example of an adverse site condition.

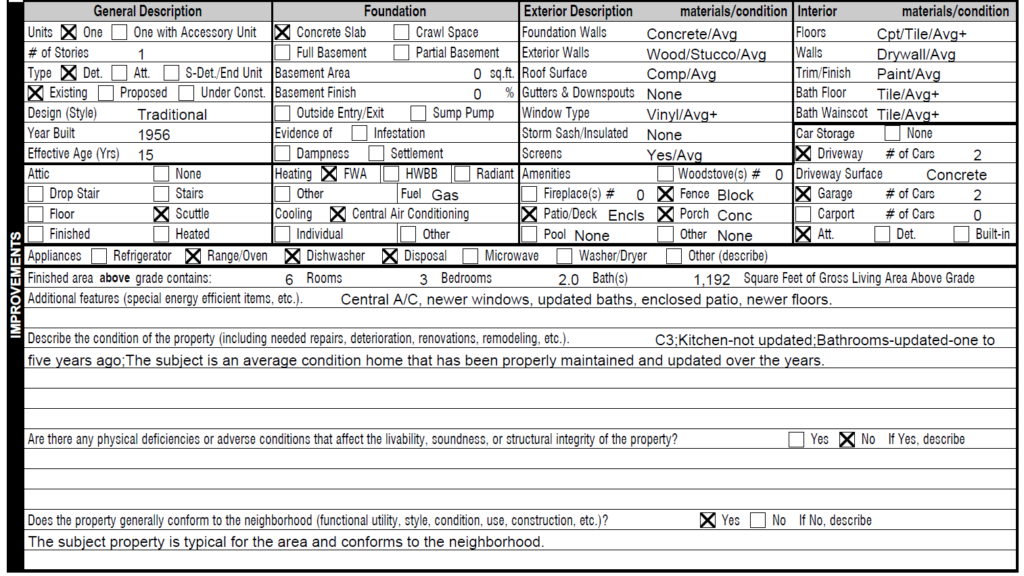

Page One – Improvements

The improvements section contains all the relevant information about the actual improvements (Your house).

It starts with the number of units, stories, type, design, age, and effective age. Effective age is different from actual age in that it is “defined as the estimate of the age of a structure based on its utility and physical wear and tear.” So the house could be 50 years old, but with current updates, it could have an effective age of 15.

The next section is for the foundation and basement information if there is a basement.

Then the report goes into the exterior and interior materials used and their current condition.

The attic and heating/cooling sections are next.

The amenities are next. These include fireplaces, patio/decks, fence type, pool, and spa.

Finally, the car storage section in the appraisal contains relevant information about parking.

The next sections are more for written commentary about the property.

Additional features will usually mention solar and other features. Then, the condition of the home is described in detail.

The next part is whether any major issues affect the home and whether or not it conforms to the neighborhood.

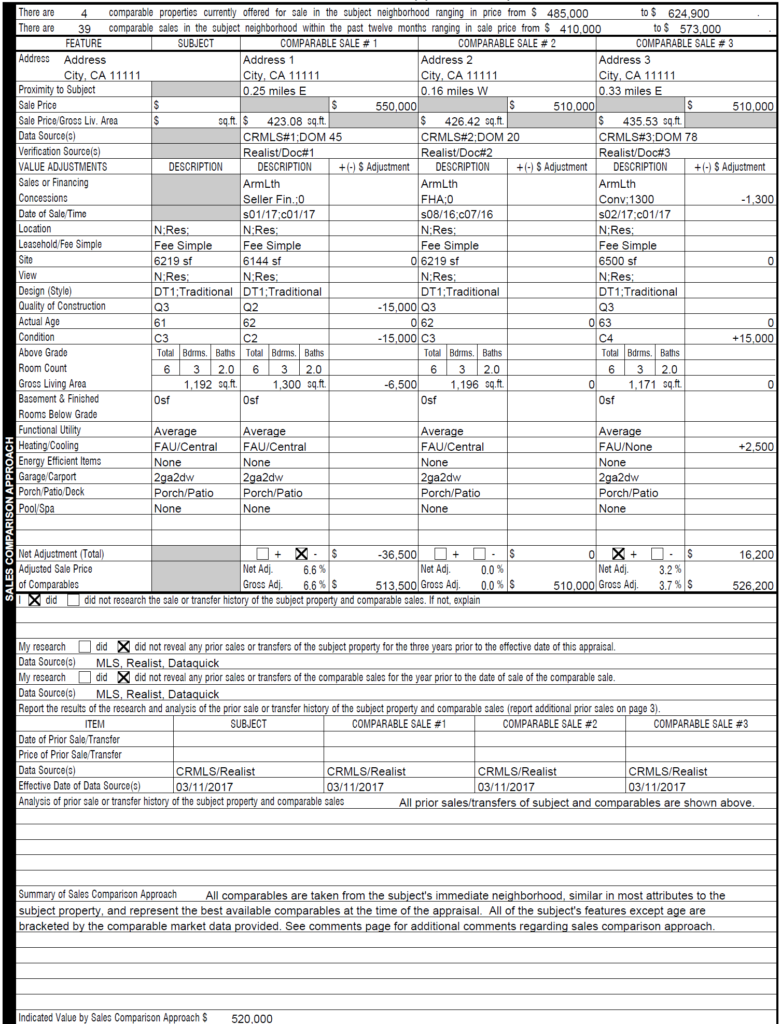

Page 2 – Sales Comparison Approach

The next page is the most important page when it comes to the valuation of the real estate.

The top section talks about the comparable listings and sales in the neighborhood. Then, it goes into the bulk of the appraisal, the Sale Comparables.

The sale comparables are recent similar sales that the appraiser chooses to determine the property’s value.

These comparables should be recent sales that are close in proximity (Preferably in the same neighborhood) and similar to the subject property in some way.

In tract neighborhoods, you will find that the properties are all similar in most characteristics, but in more diverse neighborhoods, you may see more differences.

The appraiser uses these comparables to estimate the value of your house by adjusting for the differences compared to yours.

Many methods will be used to determine the adjustments for the differences, but in the end, they should bring the final adjusted values to a range of 25% or less between the high and low.

In the 1004 form, this is the most important section because the resulting value is usually given primary emphasis when determining the appraised value.

Following the comparable grid are sections related to prior sales of the subject and comparable properties, then a summary of the Sales Comparison Approach and the indicated value.

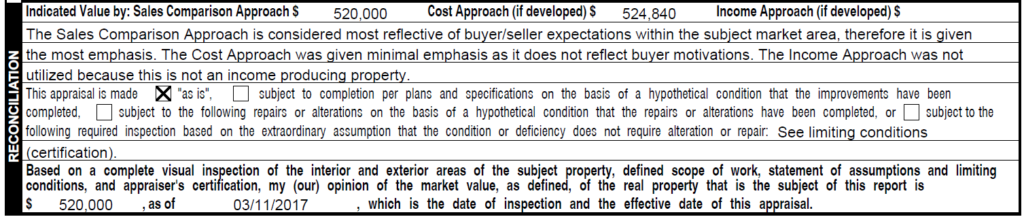

Page 2 – Reconciliation and Value

If there is only one section you read out of the entire appraisal report, it should be this one.

This is the section where all the approaches to value are reconciled together to come up with the final appraised value.

Along the top, you can see inputs for the indicated values by the Sales Comparison Approach, Cost Approach, and Income Approach.

The Sales Comparison Approach will always have a value. The Cost Approach and Income Approach may or may not depend on what the appraiser deems necessary to produce a credible result.

These are the three main approaches to value you may or may not see in most appraisals.

The next box is selected based on whether the appraisal is an “As Is” value or “Subject To” value. In most cases, it will be as is, but if your home is undergoing construction or there is some other edge case where the appraiser could not appraise the house as is, one of the two “subject to” boxes should be checked.

The final section is the appraised value, which is the value conclusion for your property in the report.

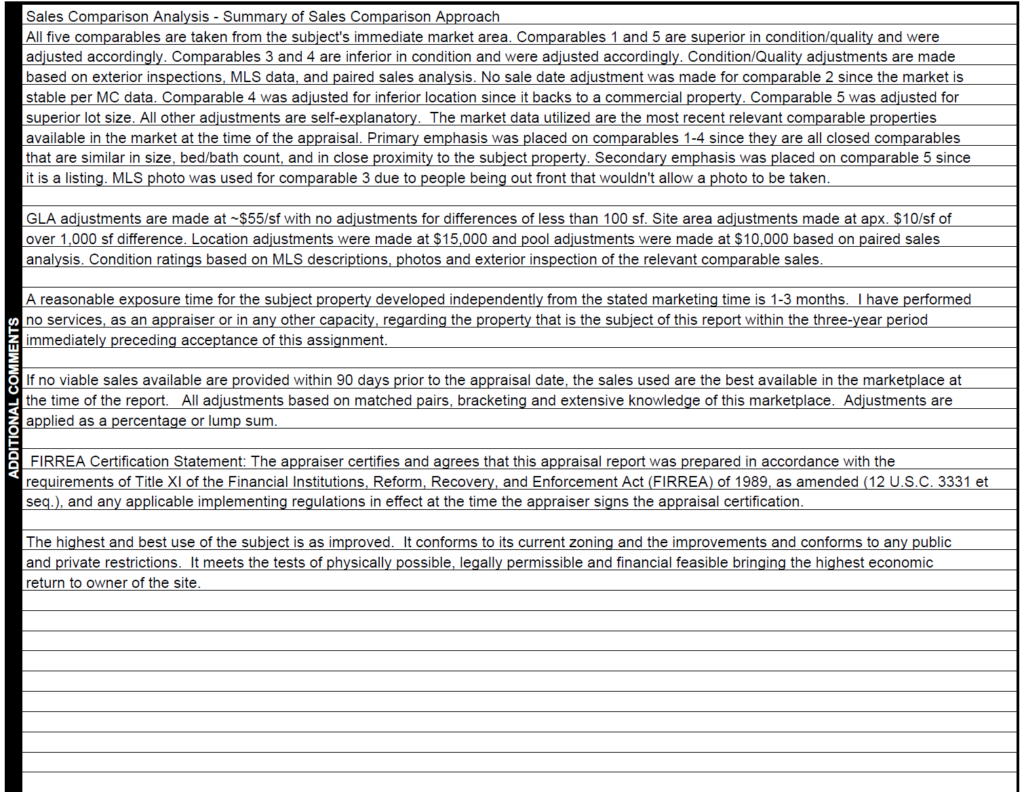

Page 3 – Additional Comments

Page three is the last property-specific information page in the appraisal report’s main part.

The first section may or may not include all of the appraiser’s commentary. Sometimes, this section is blank, and an addendum will be added at the end.

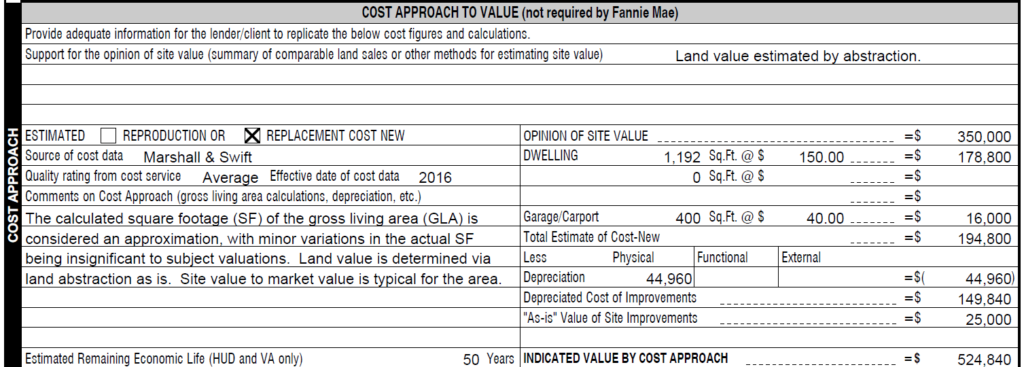

Page 3 – Cost Approach

The Cost Approach may or may not be included in the report.

Many lenders require this section, even if it may not be necessary. This is a major point of contention with appraisers, which I will not get into in this article.

The Cost Approach is another approach to value that is determined by taking the site value, plus the cost new of the improvements, less depreciation, plus the “As-Is” value of site improvements.

This approach works great with newly built properties with land comparables nearby.

This approach is much less credible with older properties with no land comparables nearby.

Page 3 – Income Approach

This section will usually not be filled out unless this is a rental property.

The Income Approach Value is determined by taking the estimated market rent times the gross rent multiplier.

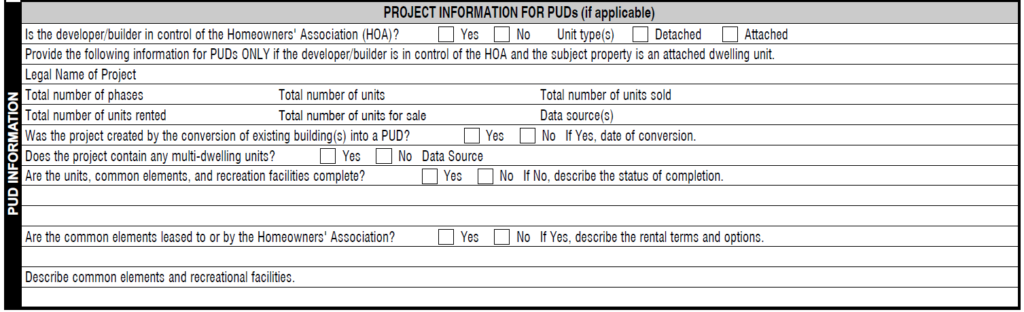

Page 3 – PUD Information

This section should contain some data if your house is in a planned development.

The top sections talk about the units’ types and the project’s name.

The following inputs are project-specific and are related to the number of units.

Then, it talks about the project facilities and whether they are complete/leased to the HOA.

Page 4-6 – Boilerplate

As mentioned above, pages 4-6 in the major form are all boilerplate text that is most likely not relevant to you.

Sketches, Maps, Photos

Once you get through these pages, the rest of the real estate appraisal report should contain property-specific sketches, maps, and photos.

If there was not a long write-up on page 3, this would also be the place for an addendum of the appraisal report details.

I like to start with the building sketch. This has the exterior dimensions of the property, with all the interior rooms labeled.

The software calculates the square footage based on the exterior dimensions measured by the appraiser at the time of the inspection.

Then, I like to add the plat map or parcel map. The city usually provides this and is the officially recorded parcel map for the property.

Next, I will include the aerial map of the subject property, the location map of the subject property, and comparables.

Following these maps, I include all the property-specific photos, followed by the photos of the comparable properties.

Additional information

Once you get past the subject-specific sketches, maps, and photos, you will probably see more boilerplate text, supporting documents, and maybe some charts and/or a market conditions addendum.

If there is a market conditions section, it will explain the market trends based on comparable data found by the appraiser.

Sometimes, this is required by the lender, but most of the time, it is not and will not be included in the report.

Conclusion

If you have made it this far, congrats!

You have probably made it through the entire appraisal report.

As you can see, many pages are filled with relevant information about the subject property, the surrounding neighborhood, and the overall market.

Many pages are boilerplate, and many pages are filled with maps, photos, sketches, and other supporting documents.

Hopefully, this article gives you a good idea of how to read an appraisal report, and if you have any questions, always feel free to ask in the comments section below!

If you are planning for a home appraisal, here is a helpful checklist you can use to prepare beer.

Frequently Asked Questions

You can find the appraisal value in two places on the report. The value will be on the cover page with the other relevant property and client information. The value will also be in the reconciliation section of the appraisal report after the Sales Comparison grid.