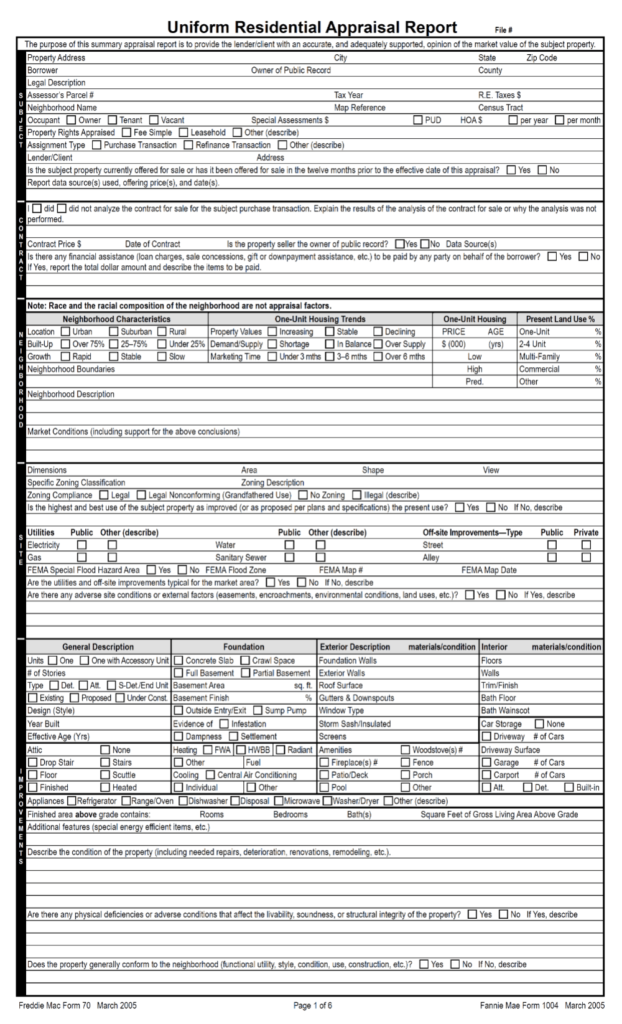

The 1004 form is an essential appraisal form in the real estate world. Used primarily for the appraisal of single-family residential properties, this form requires an interior and exterior inspection of a house. This is the most common appraisal form, often referred to as the Uniform Residential Appraisal Report (URAR).

The form was developed by the two major players in the American housing finance market, Freddie Mac and Fannie Mae. These entities devised the form for conventional lending purposes, establishing it as a standard tool for assessing property values.

While its most frequent use is for conventional refinances of homes, Form 1004 is also applicable for purchases and Federal Housing Administration (FHA) loans.

Purpose of the 1004 Appraisal Form

The main goal of the 1004 form is to provide an accurate and unbiased estimate of a subject property’s market value. Appraisers utilize this form to collect and analyze essential data points about the subject property, including its characteristics, condition, and location.

This form provides lenders with crucial information needed to assess the risk associated with lending money against the property. If the appraised value comes in lower than the sale price or loan amount, it can affect the viability of the transaction.

Use of Form 1004 in Real Estate

This form is most commonly used when a full interior and exterior inspection of a single family home is required. It is used to produce an opinion of value of a property by the real estate appraiser.

This document is one of the most common you will see in the appraisal industry and is most often used in refinances and purchases.

It can never be used for manufactured homes, condos, or multi-family properties. It may be used if the house has an accessory unit.

Components of the Uniform Residential Appraisal Report (URAR)

This report is comprehensive and detailed, including several sections that help the lender better understand the subject property and analysis.

Some of these include but are not limited to:

- Subject: This section includes basic information about the property, such as the address, parcel number, legal description, and tax data.

- Contract: If the property is under contract, this section describes the terms of the sale, including the price and date of the contract.

- Neighborhood: In this section, the appraiser describes the local neighborhood, discussing factors like housing market trends, zoning, and accessibility to amenities.

- Site: The appraiser gives an overview of the property site itself, including the lot size, zoning, utilities available, and topography.

- Improvements: This section deals with the details about the structure or improvements on the property, like the construction quality, type of dwelling, condition, room count, and any potential physical deficiencies.

- Sales Comparison Approach: The appraiser uses this approach to compare the property to recent sales or listings of similar properties in the neighborhood to determine the market value. This is where the comparable sales can be found.

- Reconciliation: This is the final section where the appraiser reconciles the information gathered and states the final estimated market value of the property.

Other components found in this report may include a street map, sketch, photos of the property, and other charts/data.

Use of the 2055 Form for Exterior-Only Inspections

For scenarios where an exterior inspection of the subject suffices, the 2055 form can be used. This form requires less detailed information compared to the 1004 form, primarily focusing on the property’s exterior condition and its surrounding neighborhood. While the 2055 form may be more convenient, the 1004 is much more accurate and complete.

Other Variations

While the 1004 form is the most common, there are variations used for other scenarios and property types.

1004C Form

The 1004C form is similar to this form in that it used by lenders and it requires an interior and exterior inspection, but it is used specifically for manufactured homes.

1004D

The 1004D form is used in two scenarios. The first is when a lender needs an “appraisal update” or a “recertification of value.” This is often used months after the original appraisal was completed in order to determine whether the value has increased, decreased, or stayed the same.

The other use case for the 1004D form is to certify that the property is complete. This is often used when the property was under construction during the original appraisal inspection, and the lender wants to confirm that the construction has been completed.

1004 Desktop and 1004 Hybrid

The 1004 Desktop and 1004 Hybrid are newer appraisal forms developed for situations where the loan to value is low and a full appraisal done by a licensed appraiser is not required. A licensed appraiser completes the report writing, but the inspection is done by any person with training (Not usually a licensed appraiser). These save lenders money and are often frowned upon by licensed appraisers for many reasons.

Conclusion

The 1004 Appraisal Form, or Uniform Residential Appraisal Report, is an indispensable tool in the real estate industry, providing a comprehensive valuation of a single-family home. Its precise and systematic approach to appraising a property helps ensure that the client can make an informed decision.